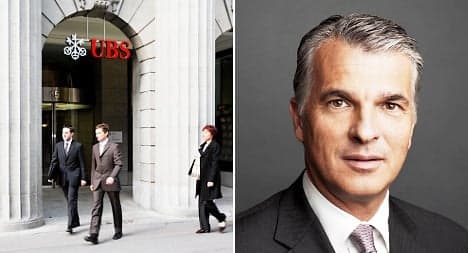

UBS reveals lofty bonuses despite losses

UBS is coming under fire after significant payouts and bonuses for top brass were divulged for 2012 despite the bank’s 2.5-billion-franc loss.

In a compensation report issued on Thursday, Switzerland’s largest bank said it paid out 70 million francs to executive committee members, around the same as the previous year when it raked in a net profit of 4.2 billion francs.

CEO Sergio Ermotti, received a salary and bonuses of 8.9 million francs, up from 6.35 million francs in 2011, a year in which he spent less than four months as chief executive.

The bank said its total bonus pool for senior managers and staff fell by 27 percent in 2012 to 2.5 billion francs from 2.7 billion francs the previous year.

However, the number of employees also dropped significantly over the period after UBS last year announced a multi-year plan to shed 10,000 jobs.

UBS Chairman Axel Weber defended the pay packages due to what he called a “positive performance” at the bank despite the red ink soaking the financial sheets.

“We have in 2012 set a new course for the future of the firm and made good progress in solving problems related to the past,” Weber was quoted as saying by the German-language SDA news agency.

Weber, who was appointed chairman in May 2012, received total compensation of more than 4.2 million francs, including shares valued at over two million francs.

In its compensation report, UBS said the bank’s underlying performance was better than the net loss posted, noting more than three billion francs in goodwill impairments, plus 1.4 billion francs in fines and costs relating to the Libor rate-fixing scandal.

The report also highlighted the fact the bank’s shares rose 28 percent over the year.

Meanwhile, pay to top executives, including Ermotti, included deferred bonuses that will only be paid if the bank meets certain targets.

The impact has not yet been felt on an initiative, passed by voters in Switzerland earlier this month, that will require binding votes by shareholders of Swiss companies on executive pay.

The initiative also bans golden parachutes and payments paid to lure executives to join a company.

The compensation report reveals that UBS offered co-head of its investment bank Andrea Orcel almost 25 million francs in deferred cash and shares to lure him away from Bank of America/Merrill last July.

The payment compensates for benefits forfeited by Orcel for leaving Bank of America, UBS said.

The deferred payments will be paid in installments this year, in 2014 and in 2015.

Such payments appear to be banned under the population initiative spearheaded by Schaffhausen businessman and independent senator Thomas Minder.

Comments

See Also

In a compensation report issued on Thursday, Switzerland’s largest bank said it paid out 70 million francs to executive committee members, around the same as the previous year when it raked in a net profit of 4.2 billion francs.

CEO Sergio Ermotti, received a salary and bonuses of 8.9 million francs, up from 6.35 million francs in 2011, a year in which he spent less than four months as chief executive.

The bank said its total bonus pool for senior managers and staff fell by 27 percent in 2012 to 2.5 billion francs from 2.7 billion francs the previous year.

However, the number of employees also dropped significantly over the period after UBS last year announced a multi-year plan to shed 10,000 jobs.

UBS Chairman Axel Weber defended the pay packages due to what he called a “positive performance” at the bank despite the red ink soaking the financial sheets.

“We have in 2012 set a new course for the future of the firm and made good progress in solving problems related to the past,” Weber was quoted as saying by the German-language SDA news agency.

Weber, who was appointed chairman in May 2012, received total compensation of more than 4.2 million francs, including shares valued at over two million francs.

In its compensation report, UBS said the bank’s underlying performance was better than the net loss posted, noting more than three billion francs in goodwill impairments, plus 1.4 billion francs in fines and costs relating to the Libor rate-fixing scandal.

The report also highlighted the fact the bank’s shares rose 28 percent over the year.

Meanwhile, pay to top executives, including Ermotti, included deferred bonuses that will only be paid if the bank meets certain targets.

The impact has not yet been felt on an initiative, passed by voters in Switzerland earlier this month, that will require binding votes by shareholders of Swiss companies on executive pay.

The initiative also bans golden parachutes and payments paid to lure executives to join a company.

The compensation report reveals that UBS offered co-head of its investment bank Andrea Orcel almost 25 million francs in deferred cash and shares to lure him away from Bank of America/Merrill last July.

The payment compensates for benefits forfeited by Orcel for leaving Bank of America, UBS said.

The deferred payments will be paid in installments this year, in 2014 and in 2015.

Such payments appear to be banned under the population initiative spearheaded by Schaffhausen businessman and independent senator Thomas Minder.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.