From climate to health insurance: Why foreigners in Switzerland should care about the federal elections

The Swiss federal elections are set to take place on October 20th. We've highlighted the policies and positions of the main political parties on areas that matter to foreign citizens living in Switzerland

The Swiss federal elections are set to take place on October 20th.

While foreigners’ voting rights are comparatively restricted in Switzerland - a topic covered extensively by The Local - plenty of our readers will be preparing to go to the polls.

Even for people who may not be able to directly participate in the upcoming elections, there are several policy proposals being put forward ahead of the poll which will no doubt have a significant impact on foreign citizens in Switzerland.

We’ve gone through some of the big issues and areas of concern for voters - from climate change to health insurance - and laid out where the parties stand, as well as if they have specific policy proposals in the area.

The parties included polled in the top five spots at the most recent Swiss Federal Election: Swiss People’s Party (SVP), The Liberals (FDP) (sometimes known as the radicals), Social Democrats (SP), Christian Democrats (CVP) and the Greens.

We've considered these parties' policies on immigration, climate change/the environment, healthcare costs, rights of foreigners to vote and pensions/social issues.

READ: A snapshot of Switzerland’s major political parties

Immigration

From being a minor area of concern throughout the 1990s, immigration has become a major issue in Switzerland in recent years - for Swiss and expats alike.

The annual Swiss ‘Sorgenbarometer’ or ‘Worry Barometer’, which has traced Swiss citizens’ principal concerns over time, shows that immigration ranks third on the list in 2019, while refugees and asylum policy ranks fourth.

Only pensions/retirement and health/health insurance, ranked first and second respectively, are greater concerns.

National broadcaster SRF defines restricting immigration as the ‘brand essence’ of the Swiss People’s Party (SVP), alongside lower taxes and less government intervention in economic policy.

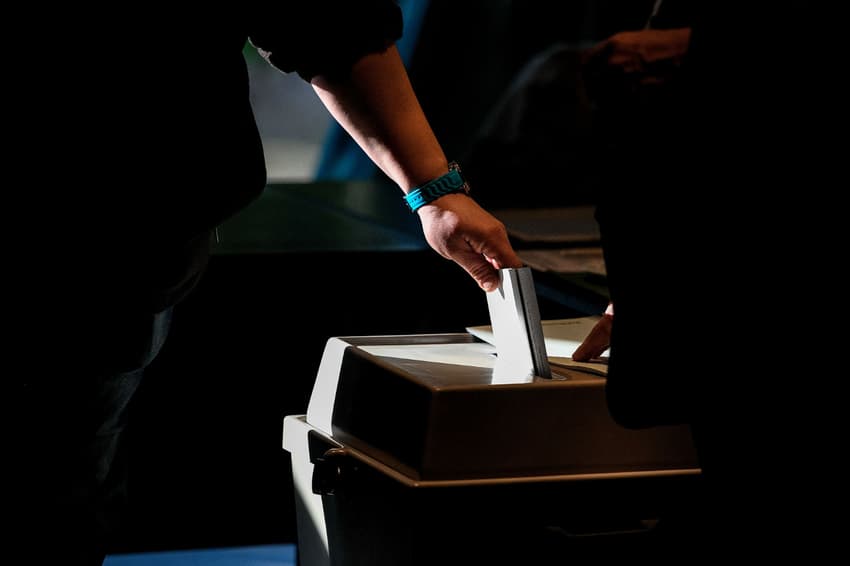

Photo: Michael Buholzer / AFP

The right-wing populist party is the largest in the Federal Assembly, growing its popularity in recent years with a range of policies which seek to restrict immigration and European integration.

The SVP opposes Switzerland joining the EU and seeks to end free movement within the bloc.

The Liberals (FDP) support the continuation of the status quo with regard to migration, arguing that immigration is essential to Switzerland’s economic security.

While the FDP opposes joining the EU, it does support a continuation of the existing free movement rules.

The Christian Democrats (CVP) wants a “self-confident Switzerland” when it comes to immigration. While the CVP wants a focus on collaboration with the EU, the party prioritises “a controlled asylum policy that focuses on integration and targeted development cooperation”.

The Greens support increased immigration in Switzerland in line with the obligations of the Refugee Convention, as well as the free movement of persons in collaboration with the EU.

Climate Change and the Environment

Climate change is another issue which has captured voter attention. While it ranks fifth on the ‘Worry Barometer’, recent stories about additional taxes on flights or an annual flight quota have captured our readers’ attention.

The SVP argues that it is the only “reasonable” voice in the climate change debate, rejecting any attempt to set a target for reducing CO2 domestically and consistently voicing scepticism on climate change.

The SVP rejects the imposition of new taxes in any way connected to climate change, including on petrol or gas and on heating in buildings.

They are opposed to any additional levy or quota on domestic flights. The SVP also states that no public money should be used for tackling environmental issues.

The centre-right Liberals (FDP) have traditionally been close to business, with less of a focus on environmental issues.

A 2019 study by independent media organisation SRG found that the Liberals have put in the fewest environmentally related proposals into parliament of any of the major parties (five per cent), behind the SVP (seven per cent).

The Liberal party platform for the upcoming election does however have a much more ‘green’ flavour, with their freshly-minted manifesto calling for increased taxes on fuel (petrol and diesel) as well as reducing emissions to zero by 2050.

The Liberals also support a tax, but not a quota, on domestic flights.

Similarly, the Christian Democrats support taxes on flights and on petrol and diesel, with the official party platform stating that “air travel is too cheap today”.

Protesters in Lucerne. Photo: FABRICE COFFRINI / AFP

The CVP does however support an exemption in petrol and diesel taxes for those in rural areas who cannot easily access public transport.

The CVP also support Switzerland’s adherence to the Paris Climate Accords.

Unsurprisingly, the Greens are the party most supportive of environmental initiatives. In total, just under a third (29 percent) of their parliamentary proposals are related to ecology, which is the equal highest with the Green Liberals.

The Greens’ official policy platform calls for the “rapid phase-out of fossil fuels, the promotion of renewable energy sources and an exit from climate-damaging investments (divestment)”.

The Social Democrats are also supportive of environmental policy, having developed the so-called ‘Glacier Initiative’, which seeks to make Switzerland carbon neutral by 2020.

Healthcare costs

The rising costs of healthcare have been identified by our readers as an area of concern. Despite the Swiss healthcare system ranking third best in the world, cost increases in premiums and deductibles have raised concerns over healthcare affordability.

The Christian Democrats (CVP) have proposed a healthcare Kostenbremse (cost brake) which will prevent costs rising over a certain amount per year relative to income.

The Social Democrats have also advocated for a cap, with insurance premiums to be no higher than ten percent of total household income, as is the case in the canton of Vaud.

The Greens support stopping any further increases in healthcare costs, but offer a ‘holistic’ approach which will require the individual cantons to pay more for healthcare, as well as a range of prevention initiatives designed to take the burden off the healthcare system.

The SVP has criticised the current system, saying that the middle class “are punished” into supporting healthcare for lower-income people.

Their policy platform is tax relief for middle class Swiss and for small to medium-sized enterprises (SMEs), including allowing health insurance premiums to be fully tax deductible.

The SVP has also argued for cutting asylum, development and aid programs in order to allow these tax cuts.

A representative told the media "there is also more than enough savings potential, for example in asylum, development aid and bloated administration. In addition, tax cuts for SMEs are also good for the economy"

The Liberals do not have a set policy on the issue.

Photo: FABRICE COFFRINI / AFP

Foreigner voting rights

Switzerland is relatively restrictive on allowing foreigners to vote, with residents only allowed to have their say in federal elections when they are successfully granted Swiss citizenship - a process which takes a minimum of ten years.

With between 70 and 80 percent of the electorate supporting the status quo, any relaxation of the law at a federal level seems unlikely - although some parties have indicated a willingness to do so at a municipal level.

The Social Democrats in Basel and Zurich have supported foreigners voting after two years of residency, reflecting foreigner voting permissions in Vaud, Fribourg, Neuchâtel, Jura, Graubunden, Basel-City and Appenzell Ausserrhoden.

Similarly the Greens and the Green Liberals have supported foreigners rights to vote in cantonal elections as “an important step for integration”.

Conversely, the centre-right Liberals (FDP) and the right-wing populist SVP are opposed. The FDP’s Titus Meier said that doing so - even at a local level - would “reduce the incentive to become a naturalised citizen”.

The SVP’s Thomas Burgherr agreed, saying the right to vote must be earned.

“Swiss citzenship cannot be free, it only exists as an achievement - and that is through naturalisation”.

The CVP have indicated a degree of hesitance to allow it without participating in other civil obligations, such as compulsory military service.

Pensions and social security

Pensions and social security issues are the number one concern for Swiss residents on the ‘Worry Barometer’.

The right-side of the Swiss political spectrum has reacted with apparent concerns about any measures which would result in increased government debt, while left-leaning parties have sought to guarantee social benefits for Swiss in the future.

The FDP supports raising the retirement age for women from 64 to 65, while placing a cap on the amount of debt the country can spend in servicing old age pensions.

The SVP feels that the state already intervenes too much with the freedom of Swiss citizens and companies. The SVP is seeking cuts in social benefits like pension payments and unemployment benefits, as well as being opposed to the Swiss government’s new parental leave scheme for fathers.

The Greens have argued for widening the social safety net and have opposed any cuts to pensions or social security.

The Social Democrats support placing a cap of 35 hours on the working week as well as investing half of its yearly surplus - or at least one billion CHF - in an education fund for the benefit of Swiss citizens.

The brake on increases in health insurance costs is the Christian Democrats major initiative, however the party has also called for a better work-life balance, equal pay for men and women and the establishment of a flexible working culture.

Like the Greens and Social Democrats, the Christian Democrats support the paid paternity leave scheme.

Comments

See Also

The Swiss federal elections are set to take place on October 20th.

While foreigners’ voting rights are comparatively restricted in Switzerland - a topic covered extensively by The Local - plenty of our readers will be preparing to go to the polls.

Even for people who may not be able to directly participate in the upcoming elections, there are several policy proposals being put forward ahead of the poll which will no doubt have a significant impact on foreign citizens in Switzerland.

We’ve gone through some of the big issues and areas of concern for voters - from climate change to health insurance - and laid out where the parties stand, as well as if they have specific policy proposals in the area.

The parties included polled in the top five spots at the most recent Swiss Federal Election: Swiss People’s Party (SVP), The Liberals (FDP) (sometimes known as the radicals), Social Democrats (SP), Christian Democrats (CVP) and the Greens.

We've considered these parties' policies on immigration, climate change/the environment, healthcare costs, rights of foreigners to vote and pensions/social issues.

READ: A snapshot of Switzerland’s major political parties

Immigration

From being a minor area of concern throughout the 1990s, immigration has become a major issue in Switzerland in recent years - for Swiss and expats alike.

The annual Swiss ‘Sorgenbarometer’ or ‘Worry Barometer’, which has traced Swiss citizens’ principal concerns over time, shows that immigration ranks third on the list in 2019, while refugees and asylum policy ranks fourth.

Only pensions/retirement and health/health insurance, ranked first and second respectively, are greater concerns.

National broadcaster SRF defines restricting immigration as the ‘brand essence’ of the Swiss People’s Party (SVP), alongside lower taxes and less government intervention in economic policy.

Photo: Michael Buholzer / AFP

The right-wing populist party is the largest in the Federal Assembly, growing its popularity in recent years with a range of policies which seek to restrict immigration and European integration.

The SVP opposes Switzerland joining the EU and seeks to end free movement within the bloc.

The Liberals (FDP) support the continuation of the status quo with regard to migration, arguing that immigration is essential to Switzerland’s economic security.

While the FDP opposes joining the EU, it does support a continuation of the existing free movement rules.

The Christian Democrats (CVP) wants a “self-confident Switzerland” when it comes to immigration. While the CVP wants a focus on collaboration with the EU, the party prioritises “a controlled asylum policy that focuses on integration and targeted development cooperation”.

The Greens support increased immigration in Switzerland in line with the obligations of the Refugee Convention, as well as the free movement of persons in collaboration with the EU.

Climate Change and the Environment

Climate change is another issue which has captured voter attention. While it ranks fifth on the ‘Worry Barometer’, recent stories about additional taxes on flights or an annual flight quota have captured our readers’ attention.

The SVP argues that it is the only “reasonable” voice in the climate change debate, rejecting any attempt to set a target for reducing CO2 domestically and consistently voicing scepticism on climate change.

The SVP rejects the imposition of new taxes in any way connected to climate change, including on petrol or gas and on heating in buildings.

They are opposed to any additional levy or quota on domestic flights. The SVP also states that no public money should be used for tackling environmental issues.

The centre-right Liberals (FDP) have traditionally been close to business, with less of a focus on environmental issues.

A 2019 study by independent media organisation SRG found that the Liberals have put in the fewest environmentally related proposals into parliament of any of the major parties (five per cent), behind the SVP (seven per cent).

The Liberal party platform for the upcoming election does however have a much more ‘green’ flavour, with their freshly-minted manifesto calling for increased taxes on fuel (petrol and diesel) as well as reducing emissions to zero by 2050.

The Liberals also support a tax, but not a quota, on domestic flights.

Similarly, the Christian Democrats support taxes on flights and on petrol and diesel, with the official party platform stating that “air travel is too cheap today”.

Protesters in Lucerne. Photo: FABRICE COFFRINI / AFP

The CVP does however support an exemption in petrol and diesel taxes for those in rural areas who cannot easily access public transport.

The CVP also support Switzerland’s adherence to the Paris Climate Accords.

Unsurprisingly, the Greens are the party most supportive of environmental initiatives. In total, just under a third (29 percent) of their parliamentary proposals are related to ecology, which is the equal highest with the Green Liberals.

The Greens’ official policy platform calls for the “rapid phase-out of fossil fuels, the promotion of renewable energy sources and an exit from climate-damaging investments (divestment)”.

The Social Democrats are also supportive of environmental policy, having developed the so-called ‘Glacier Initiative’, which seeks to make Switzerland carbon neutral by 2020.

Healthcare costs

The rising costs of healthcare have been identified by our readers as an area of concern. Despite the Swiss healthcare system ranking third best in the world, cost increases in premiums and deductibles have raised concerns over healthcare affordability.

The Christian Democrats (CVP) have proposed a healthcare Kostenbremse (cost brake) which will prevent costs rising over a certain amount per year relative to income.

The Social Democrats have also advocated for a cap, with insurance premiums to be no higher than ten percent of total household income, as is the case in the canton of Vaud.

The Greens support stopping any further increases in healthcare costs, but offer a ‘holistic’ approach which will require the individual cantons to pay more for healthcare, as well as a range of prevention initiatives designed to take the burden off the healthcare system.

The SVP has criticised the current system, saying that the middle class “are punished” into supporting healthcare for lower-income people.

Their policy platform is tax relief for middle class Swiss and for small to medium-sized enterprises (SMEs), including allowing health insurance premiums to be fully tax deductible.

The SVP has also argued for cutting asylum, development and aid programs in order to allow these tax cuts.

A representative told the media "there is also more than enough savings potential, for example in asylum, development aid and bloated administration. In addition, tax cuts for SMEs are also good for the economy"

The Liberals do not have a set policy on the issue.

Photo: FABRICE COFFRINI / AFP

Foreigner voting rights

Switzerland is relatively restrictive on allowing foreigners to vote, with residents only allowed to have their say in federal elections when they are successfully granted Swiss citizenship - a process which takes a minimum of ten years.

With between 70 and 80 percent of the electorate supporting the status quo, any relaxation of the law at a federal level seems unlikely - although some parties have indicated a willingness to do so at a municipal level.

The Social Democrats in Basel and Zurich have supported foreigners voting after two years of residency, reflecting foreigner voting permissions in Vaud, Fribourg, Neuchâtel, Jura, Graubunden, Basel-City and Appenzell Ausserrhoden.

Similarly the Greens and the Green Liberals have supported foreigners rights to vote in cantonal elections as “an important step for integration”.

Conversely, the centre-right Liberals (FDP) and the right-wing populist SVP are opposed. The FDP’s Titus Meier said that doing so - even at a local level - would “reduce the incentive to become a naturalised citizen”.

The SVP’s Thomas Burgherr agreed, saying the right to vote must be earned.

“Swiss citzenship cannot be free, it only exists as an achievement - and that is through naturalisation”.

The CVP have indicated a degree of hesitance to allow it without participating in other civil obligations, such as compulsory military service.

Pensions and social security

Pensions and social security issues are the number one concern for Swiss residents on the ‘Worry Barometer’.

The right-side of the Swiss political spectrum has reacted with apparent concerns about any measures which would result in increased government debt, while left-leaning parties have sought to guarantee social benefits for Swiss in the future.

The FDP supports raising the retirement age for women from 64 to 65, while placing a cap on the amount of debt the country can spend in servicing old age pensions.

The SVP feels that the state already intervenes too much with the freedom of Swiss citizens and companies. The SVP is seeking cuts in social benefits like pension payments and unemployment benefits, as well as being opposed to the Swiss government’s new parental leave scheme for fathers.

The Greens have argued for widening the social safety net and have opposed any cuts to pensions or social security.

The Social Democrats support placing a cap of 35 hours on the working week as well as investing half of its yearly surplus - or at least one billion CHF - in an education fund for the benefit of Swiss citizens.

The brake on increases in health insurance costs is the Christian Democrats major initiative, however the party has also called for a better work-life balance, equal pay for men and women and the establishment of a flexible working culture.

Like the Greens and Social Democrats, the Christian Democrats support the paid paternity leave scheme.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.