OPINION: The benefits of raising children in Switzerland

It's easy to complain about the long cold winters and the language barrier - but for many foreign parents raising children in Switzerland, the benefits far outweigh the negatives.

Global surveys ranking the ‘best places to raise children’ often place Switzerland in the top ten, and a recent U.S. News & World Report annual survey placed Switzerland in seventh place globally for raising children in 2018.

After moving to Switzerland from Australia a year ago, I vividly remember calming my then six-year-old daughter and four-year-old son down on their first day of school. I felt like a spokesperson from Swiss Tourism as I overcame every one of their objections with a smile and an interesting new fact about their new school and new home. But what my children didn’t know is that although I was keeping my cool on the exterior, I too was nervous, unsure and afraid.

However, after about a month of living in Switzerland, I soon realized my children were thriving and my personal objections to raising children here became the very reason I wanted to stay. Together, we have embraced learning German and are enjoying a healthier and more active lifestyle.

In fact, the more parents I spoke to, the more I heard the same sentiment: "Switzerland is a great place to raise children: that’s one of the main reasons we stay." It seemed that although parents missed home, they could not deny the advantages and opportunities that come with raising children here.

Four mothers from different places of origin gave me their view on the main benefits of raising a child in Switzerland. Here is what they said.

1. Child safety and autonomy

For mum-of-three Claudia Hug, the main benefit of raising children in Switzerland is the freedom her children enjoy. Originally from São Paulo, Brazil, the working mother can already see the benefits of raising her children in Zurich.

"Here you don’t need all the security apparatuses and measurements I needed in São Paulo. My daughter was 16 when we arrived and my son was nine, and so quickly they became much more independent and freer," she says.

"My daughter could go to parties without depending on me to drive her. My son has the freedom of inviting friends over and visiting them as well, without me having to drive around. That is a major step up in quality of life. I think the whole school Swiss system is not perfect, of course, but it gives to the child a much more inclusive and fair view of life."

2. Children explore nature and the outdoors

Pragati Siddhanti, originally from India, is a working mother living in Basel. For Siddhanti, the major benefit of living in Basel is first and foremost the safety she feels for her eight-year-old daughter, but she is also delighted about how outdoor play is encouraged.

"Children have the freedom to walk alone, and a lot of other things. They are not constantly in an overly protective environment which makes them quite confident and independent from an early age.

"Also, the importance of being outdoors and playing sports - with so many parks, facilities, and great sports camps/classes is great. I love the culture where kids spend a lot of time outdoors, go for forest walks, swim and ski at an early age - all important life skills to have," she says.

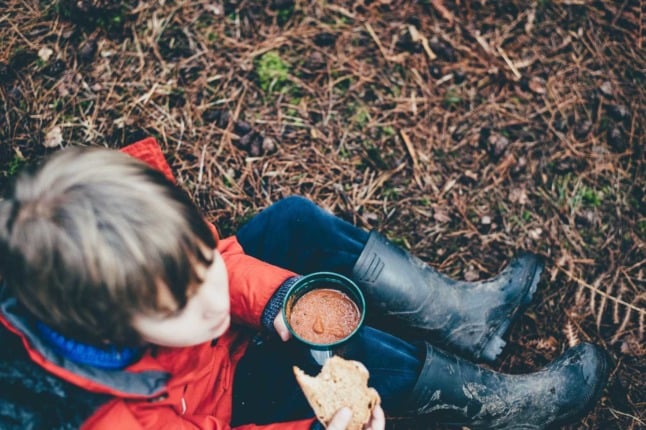

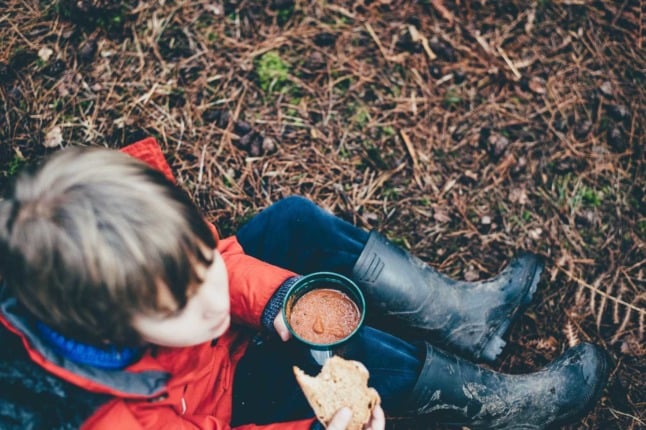

A child sits with a piece of bread and a can of soup. Photo by Annie Spratt on Unsplash

3. A world-class education

Single mother, Riham Youssef moved from New York to Geneva and also rates child safety and outdoor play highly in Switzerland, but she praises the Swiss schooling system as the top benefit of childhood here. The mother of twin four-year-olds is amazed by the quality of education her children are receiving in their new home.

"My twins were born in Manhattan, a city I absolutely love. Yet I left it when they were one-year-olds for the sole reason of raising my children here, in a healthy and safe environment, with so many green spaces and fun outdoor activities for the little ones," says Youssef.

"The education system is also exceptional. My children started school in September, and in just a few months they have truly blossomed. Educators give outstanding individual attention to each child and help them reach the maximum of their potential."

4. Children can come home for lunch

Tala Daniela von Däniken, originally from England, has lived in Switzerland for 18 years and is the mother of two girls – a ten-month-old baby and an eight-year-old girl. The Zurich-based mum also loves the independence that children have from such an early age.

At the same time, she really appreciates the quality time she has with her daughter when she comes home for lunch.

"I don’t think there is anywhere else in the world where four-year-olds walk to kindergarten alone...and as much as I often find it inconvenient that children come home for lunch, as I have to rush so much with my baby to be home and have lunch on the table - another mother pointed out to me that it’s nice to have time with your child at lunchtime, as dinner time is too rushed and leads to bedtime, so you don’t have the same quality time in the evenings," she says.

What do you think are the main benefits of raising children in Switzerland? Let us know here.

Comments (2)

See Also

Global surveys ranking the ‘best places to raise children’ often place Switzerland in the top ten, and a recent U.S. News & World Report annual survey placed Switzerland in seventh place globally for raising children in 2018.

After moving to Switzerland from Australia a year ago, I vividly remember calming my then six-year-old daughter and four-year-old son down on their first day of school. I felt like a spokesperson from Swiss Tourism as I overcame every one of their objections with a smile and an interesting new fact about their new school and new home. But what my children didn’t know is that although I was keeping my cool on the exterior, I too was nervous, unsure and afraid.

However, after about a month of living in Switzerland, I soon realized my children were thriving and my personal objections to raising children here became the very reason I wanted to stay. Together, we have embraced learning German and are enjoying a healthier and more active lifestyle.

In fact, the more parents I spoke to, the more I heard the same sentiment: "Switzerland is a great place to raise children: that’s one of the main reasons we stay." It seemed that although parents missed home, they could not deny the advantages and opportunities that come with raising children here.

Four mothers from different places of origin gave me their view on the main benefits of raising a child in Switzerland. Here is what they said.

1. Child safety and autonomy

For mum-of-three Claudia Hug, the main benefit of raising children in Switzerland is the freedom her children enjoy. Originally from São Paulo, Brazil, the working mother can already see the benefits of raising her children in Zurich.

"Here you don’t need all the security apparatuses and measurements I needed in São Paulo. My daughter was 16 when we arrived and my son was nine, and so quickly they became much more independent and freer," she says.

"My daughter could go to parties without depending on me to drive her. My son has the freedom of inviting friends over and visiting them as well, without me having to drive around. That is a major step up in quality of life. I think the whole school Swiss system is not perfect, of course, but it gives to the child a much more inclusive and fair view of life."

Pragati Siddhanti, originally from India, is a working mother living in Basel. For Siddhanti, the major benefit of living in Basel is first and foremost the safety she feels for her eight-year-old daughter, but she is also delighted about how outdoor play is encouraged.

"Children have the freedom to walk alone, and a lot of other things. They are not constantly in an overly protective environment which makes them quite confident and independent from an early age.

"Also, the importance of being outdoors and playing sports - with so many parks, facilities, and great sports camps/classes is great. I love the culture where kids spend a lot of time outdoors, go for forest walks, swim and ski at an early age - all important life skills to have," she says.

3. A world-class education

Single mother, Riham Youssef moved from New York to Geneva and also rates child safety and outdoor play highly in Switzerland, but she praises the Swiss schooling system as the top benefit of childhood here. The mother of twin four-year-olds is amazed by the quality of education her children are receiving in their new home.

"My twins were born in Manhattan, a city I absolutely love. Yet I left it when they were one-year-olds for the sole reason of raising my children here, in a healthy and safe environment, with so many green spaces and fun outdoor activities for the little ones," says Youssef.

"The education system is also exceptional. My children started school in September, and in just a few months they have truly blossomed. Educators give outstanding individual attention to each child and help them reach the maximum of their potential."

Tala Daniela von Däniken, originally from England, has lived in Switzerland for 18 years and is the mother of two girls – a ten-month-old baby and an eight-year-old girl. The Zurich-based mum also loves the independence that children have from such an early age.

At the same time, she really appreciates the quality time she has with her daughter when she comes home for lunch.

"I don’t think there is anywhere else in the world where four-year-olds walk to kindergarten alone...and as much as I often find it inconvenient that children come home for lunch, as I have to rush so much with my baby to be home and have lunch on the table - another mother pointed out to me that it’s nice to have time with your child at lunchtime, as dinner time is too rushed and leads to bedtime, so you don’t have the same quality time in the evenings," she says.

What do you think are the main benefits of raising children in Switzerland? Let us know here.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.