Swiss car insurance: Why do foreigners pay higher premiums?

Overcharging foreign nationals for auto insurance is banned in the European Union, but in Switzerland it is not only allowed, but also widely practiced.

Depending on the motorist’s nationality, Swiss insurers charge up to 60 percent more for car insurance premiums, regardless of the number of accidents or the make of the car, according to an article in the Sunday edition of Blick.

For Mustafa Atici, president of the migrant section of the Social Democratic Party, this practice “is pure discrimination. Thousands of people have to pay more without ever having caused an accident”.

He conceded that many young immigrant drivers may be more often involved in crashes, "but punishing everyone who has the same nationality is not fair”, he said.

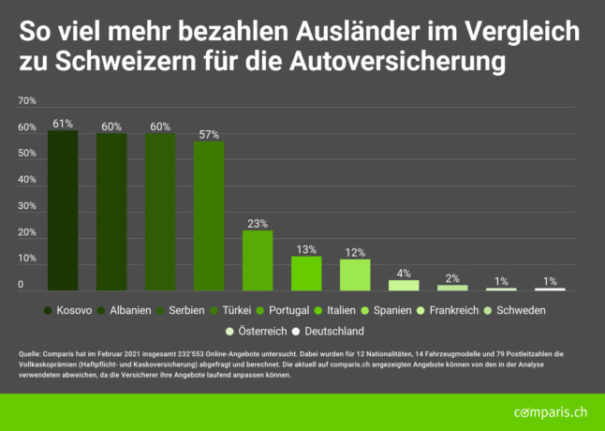

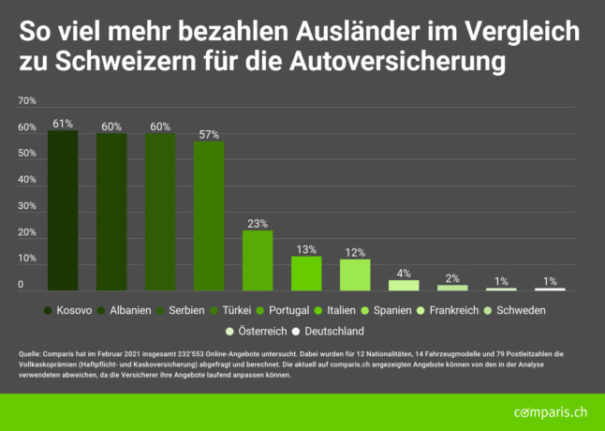

In March, the consumer site Comparis.ch published a chart showing how much more foreigners pay for car insurance, based on their nationality and when compared to Swiss drivers.

Kosovars, Albanians, Serbs and Turks bear the brunt of this practice, paying on average around 60 percent more than the Swiss.

Premiums for Portuguese, Spanish and Italian drivers are also two-digits higher, while the surcharge on the French, Swedes, Austrians, and Germans is the lowest.

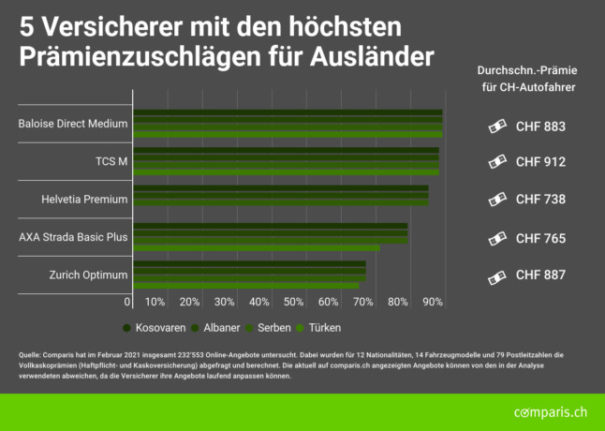

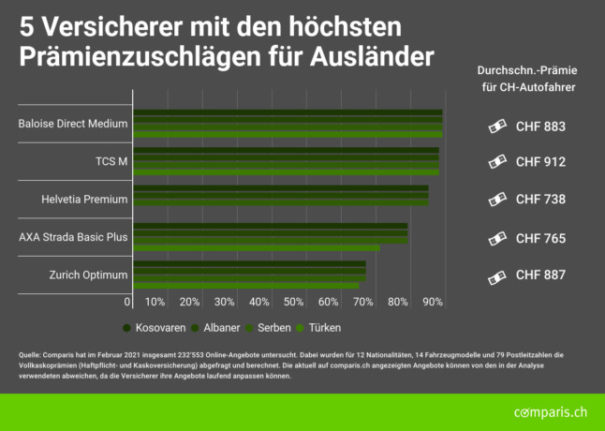

And premiums also vary from one insurance carrier to another. As this Comparis chart shows, in some cases individual prices are up to 90 percent higher.

How do insurance carriers justify this disparity between nationalities and between the Swiss and foreign drivers?

For insurance companies, this practice has less to do with discrimination and more with statistical risk profile.

For instance, if a man of foreign origin causes an accident with a high-powered car, all of these factors are included in the statistics.

If this happens more than once, a risk profile is created and applied to all people with the same characteristic.

"The individual premium for some may appear unfair, but the calculation of premiums is based on statistics", according to Comparis' mobility expert, Andrea Auer.

“Even if they have never had an accident, any driver is likely to be subject to an additional premium because the risk assessment is not individual, but collective", Auer said.

READ MORE: MAPS: Which Swiss canton has the worst drivers?

Comments

See Also

Depending on the motorist’s nationality, Swiss insurers charge up to 60 percent more for car insurance premiums, regardless of the number of accidents or the make of the car, according to an article in the Sunday edition of Blick.

For Mustafa Atici, president of the migrant section of the Social Democratic Party, this practice “is pure discrimination. Thousands of people have to pay more without ever having caused an accident”.

He conceded that many young immigrant drivers may be more often involved in crashes, "but punishing everyone who has the same nationality is not fair”, he said.

In March, the consumer site Comparis.ch published a chart showing how much more foreigners pay for car insurance, based on their nationality and when compared to Swiss drivers.

Kosovars, Albanians, Serbs and Turks bear the brunt of this practice, paying on average around 60 percent more than the Swiss.

Premiums for Portuguese, Spanish and Italian drivers are also two-digits higher, while the surcharge on the French, Swedes, Austrians, and Germans is the lowest.

And premiums also vary from one insurance carrier to another. As this Comparis chart shows, in some cases individual prices are up to 90 percent higher.

How do insurance carriers justify this disparity between nationalities and between the Swiss and foreign drivers?

For insurance companies, this practice has less to do with discrimination and more with statistical risk profile.

For instance, if a man of foreign origin causes an accident with a high-powered car, all of these factors are included in the statistics.

If this happens more than once, a risk profile is created and applied to all people with the same characteristic.

"The individual premium for some may appear unfair, but the calculation of premiums is based on statistics", according to Comparis' mobility expert, Andrea Auer.

“Even if they have never had an accident, any driver is likely to be subject to an additional premium because the risk assessment is not individual, but collective", Auer said.

READ MORE: MAPS: Which Swiss canton has the worst drivers?

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.