Swiss real estate 'bubble risk' continues to rise

The risk of a real estate bubble occurring in several regions of Switzerland reached its highest level at the end of 2015 since the late 1980s, according to a report from UBS.

The bank on Thursday said its Swiss Real Estate Bubble Index reached 1.41 points in the fourth quarter of last year, up from 1.34 in the third quarter and the highest rate in around 15 years.

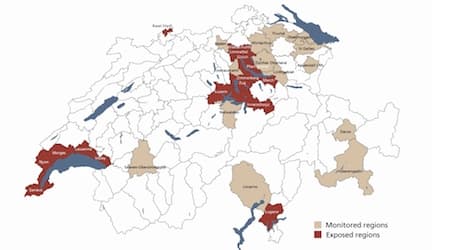

The Lake Geneva and Greater Zurich areas remain the most exposed regions in the country with the highest risk potential for a residential real estate bubble.

Other exposed cities include Zug, Lucerne, Basel and Lausanne.

Lugano joined the list of most exposed residential property markets after being considered a “monitored” region in the third quarter of 2015.

“The highest price rises for homes shifted last year from the centre of the country to the periphery,” the UBS report said.

“Eastern Switzerland with a four to six percent increase swung to the top, and the regions of Thurtal, Upper Thurgau and Linth appeared for the first time on the map.”

By contrast, the bank said, the tourism regions such as Davos and the Upper Engadine, came under pressure with prices falling as a result of oversupply and the strong Swiss franc.

A number of factors are underpinning the risks of an overheated market, the bank’s report showed.

Chief among them is the fact that mortgage debt growth last year surpassed that of income “at a rate not seen since 2010".

The ratio of owner-occupied house prices relative to rents rose in the fourth quarter of 2015 to 28.7, well above the long-term average ratio of 25, as rents stagnated.

Home prices, meanwhile, rose two percent (or 3.3 percent adjusted for inflation, which was negative) from the period a year earlier, marking a period of continuous growth since 2000.

All this is pushing the housing market in some areas dangerously close to the bubble conditions of the late 1980s, which were followed by a collapse in prices in the 1990s.

For more on the report, check here.

Comments

See Also

The bank on Thursday said its Swiss Real Estate Bubble Index reached 1.41 points in the fourth quarter of last year, up from 1.34 in the third quarter and the highest rate in around 15 years.

The Lake Geneva and Greater Zurich areas remain the most exposed regions in the country with the highest risk potential for a residential real estate bubble.

Other exposed cities include Zug, Lucerne, Basel and Lausanne.

Lugano joined the list of most exposed residential property markets after being considered a “monitored” region in the third quarter of 2015.

“The highest price rises for homes shifted last year from the centre of the country to the periphery,” the UBS report said.

“Eastern Switzerland with a four to six percent increase swung to the top, and the regions of Thurtal, Upper Thurgau and Linth appeared for the first time on the map.”

By contrast, the bank said, the tourism regions such as Davos and the Upper Engadine, came under pressure with prices falling as a result of oversupply and the strong Swiss franc.

A number of factors are underpinning the risks of an overheated market, the bank’s report showed.

Chief among them is the fact that mortgage debt growth last year surpassed that of income “at a rate not seen since 2010".

The ratio of owner-occupied house prices relative to rents rose in the fourth quarter of 2015 to 28.7, well above the long-term average ratio of 25, as rents stagnated.

Home prices, meanwhile, rose two percent (or 3.3 percent adjusted for inflation, which was negative) from the period a year earlier, marking a period of continuous growth since 2000.

All this is pushing the housing market in some areas dangerously close to the bubble conditions of the late 1980s, which were followed by a collapse in prices in the 1990s.

For more on the report, check here.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.