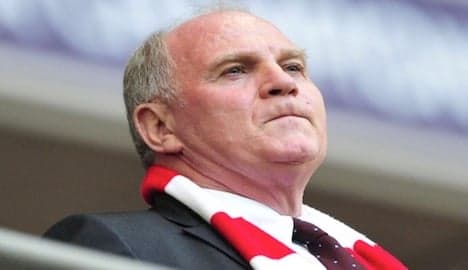

Bayern boss contests Swiss account claims

Bayern Munich boss Uli Hoeness said on Thursday he will take legal action over allegations he hid more than a hundred million euros in a Swiss bank account, which he says amount to slander.

The 61-year-old Hoeness was last week charged with tax evasion by state prosecutors in Munich, after being arrested and released on bail in March, following a high-profile probe that has rocked German sport and politics.

Fresh allegations published by Stern news magazine on Wednesday said an anonymous informant had submitted new evidence to prosecutors in the tax evasion case against the Bayern Munich president.

Stern said the informant indicated Hoeness had spirited away €350 million into a secret Swiss bank account to evade paying tax in Germany – far more than the €15 to 20 million he had previously admitted to.

The report also claims a further three Swiss accounts have been linked to the Bayern boss. The club president vehemently denies these allegations and says he will fight to clear his name.

The Hoeness case blew open in January when the same paper reported it had discovered a Swiss account containing huge sums of money in the name of an unnamed important person in German football.

Not long after, Hoeness turned himself into tax authorities, but has always denied any connection between his decision and the initial Stern report.

Until now Hoeness has always openly admitted to wrongdoing. He admitted in a magazine interview published in April that he had stashed millions of euros away from the German taxman thanks to Switzerland's bank secrecy laws.

But, he told journalists at the FC-Bayern-Charity-Golfcup event on Thursday, these latest allegations - which he dismissed as “absurd untruths” - were a step too far.

“These things won't get any truer by repeating them. I've decided to take action against this now,” said Hoeneß. “I instructed my lawyer last night ... to take action against this madness, to initiate libel proceedings.”

“They are monstrous allegations, I'm not putting up with it anymore. I'm going to fight it with every thing I have. I'm going on the offensive,” he warned.

A ruling on whether the case will go to trial is expected at the end of September.

Comments

See Also

The 61-year-old Hoeness was last week charged with tax evasion by state prosecutors in Munich, after being arrested and released on bail in March, following a high-profile probe that has rocked German sport and politics.

Fresh allegations published by Stern news magazine on Wednesday said an anonymous informant had submitted new evidence to prosecutors in the tax evasion case against the Bayern Munich president.

Stern said the informant indicated Hoeness had spirited away €350 million into a secret Swiss bank account to evade paying tax in Germany – far more than the €15 to 20 million he had previously admitted to.

The report also claims a further three Swiss accounts have been linked to the Bayern boss. The club president vehemently denies these allegations and says he will fight to clear his name.

The Hoeness case blew open in January when the same paper reported it had discovered a Swiss account containing huge sums of money in the name of an unnamed important person in German football.

Not long after, Hoeness turned himself into tax authorities, but has always denied any connection between his decision and the initial Stern report.

Until now Hoeness has always openly admitted to wrongdoing. He admitted in a magazine interview published in April that he had stashed millions of euros away from the German taxman thanks to Switzerland's bank secrecy laws.

But, he told journalists at the FC-Bayern-Charity-Golfcup event on Thursday, these latest allegations - which he dismissed as “absurd untruths” - were a step too far.

“These things won't get any truer by repeating them. I've decided to take action against this now,” said Hoeneß. “I instructed my lawyer last night ... to take action against this madness, to initiate libel proceedings.”

“They are monstrous allegations, I'm not putting up with it anymore. I'm going to fight it with every thing I have. I'm going on the offensive,” he warned.

A ruling on whether the case will go to trial is expected at the end of September.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.