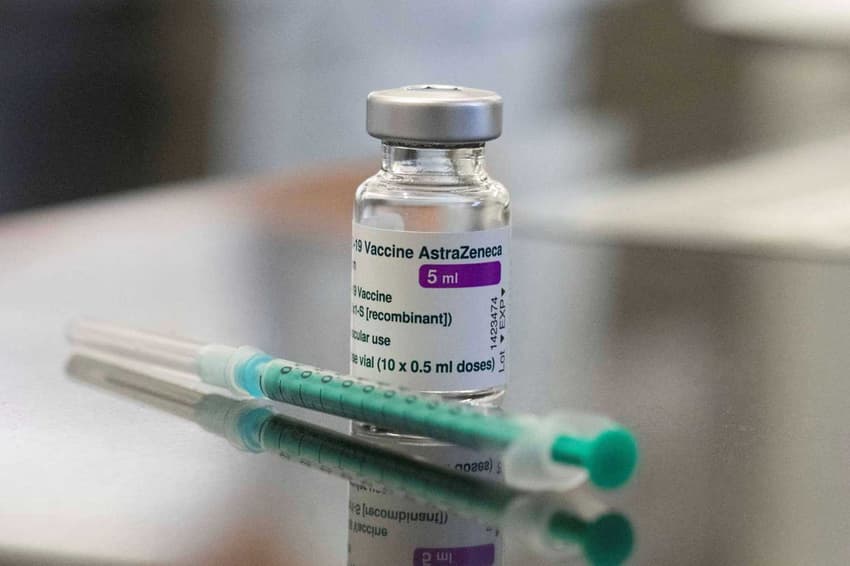

Switzerland considers selling millions of AstraZeneca vaccine doses

Switzerland is currently investigating selling on the 5.3 million doses of the AstraZeneca vaccine it agreed to purchase. Switzerland declined to approve the vaccine in February.

The Swiss government wants to sell the 5.3 million doses it had already paid for, according to an article in NZZ am Sonntag.

“We are currently considering selling on the material” said Nora Kronig, deputy director of the Federal Office of Public Health.

READ MORE: Switzerland declines to approve AstraZeneca vaccine

NZZ claims the decision was made because “AstraZeneca's vaccine has a bad reputation”.

“In the current situation, Switzerland is not dependent on the the vaccines from AstraZeneca”, said Kronig.

Originally, the AstraZeneca vaccine was expected to make up around one seventh of the total vaccine doses in Switzerland’s entire vaccine drive.

ANALYSIS: Will Switzerland's rejection of the AstraZeneca vaccine delay vaccinations?

However, at the beginning of February, the regulatory agency Swissmedic said that “the data currently available do not point to a positive decision regarding benefits and risks" of this vaccine.

Vaccines from four other manufacturers have been approved for use in Switzerland. They are Pfizer/BioNtech, Moderna, Curevac , and Novavax.

So far only two vaccines have been administered in Switzerland: those from Pfizer/BioNtech and Moderna.

There have so far been no indications as to who would be the likely recipient of the 5.3 million doses, or under what circumstances and conditions the sale would be made.

Comments

See Also

The Swiss government wants to sell the 5.3 million doses it had already paid for, according to an article in NZZ am Sonntag.

“We are currently considering selling on the material” said Nora Kronig, deputy director of the Federal Office of Public Health.

READ MORE: Switzerland declines to approve AstraZeneca vaccine

NZZ claims the decision was made because “AstraZeneca's vaccine has a bad reputation”.

“In the current situation, Switzerland is not dependent on the the vaccines from AstraZeneca”, said Kronig.

Originally, the AstraZeneca vaccine was expected to make up around one seventh of the total vaccine doses in Switzerland’s entire vaccine drive.

ANALYSIS: Will Switzerland's rejection of the AstraZeneca vaccine delay vaccinations?

However, at the beginning of February, the regulatory agency Swissmedic said that “the data currently available do not point to a positive decision regarding benefits and risks" of this vaccine.

Vaccines from four other manufacturers have been approved for use in Switzerland. They are Pfizer/BioNtech, Moderna, Curevac , and Novavax.

So far only two vaccines have been administered in Switzerland: those from Pfizer/BioNtech and Moderna.

There have so far been no indications as to who would be the likely recipient of the 5.3 million doses, or under what circumstances and conditions the sale would be made.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.