Swiss property prices see strongest rise in years

Residential property prices in Switzerland experienced one of the strongest price increases in recent years, new figures show.

During the first nine months of this year, house prices rose by 6.2 percent, while apartments went up by 5.2 percent, according to RealAdvisor appraisal platform

Where are the properties most expensive?

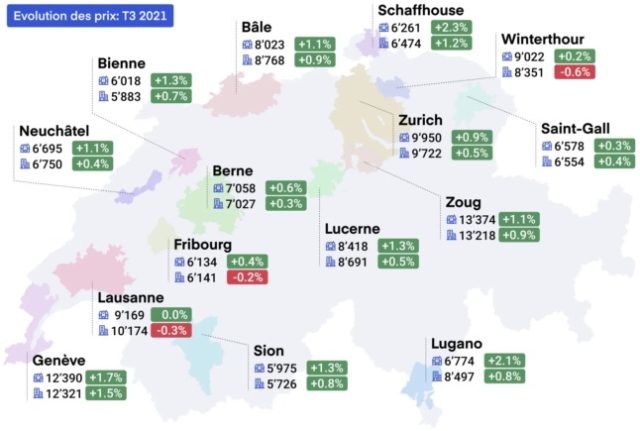

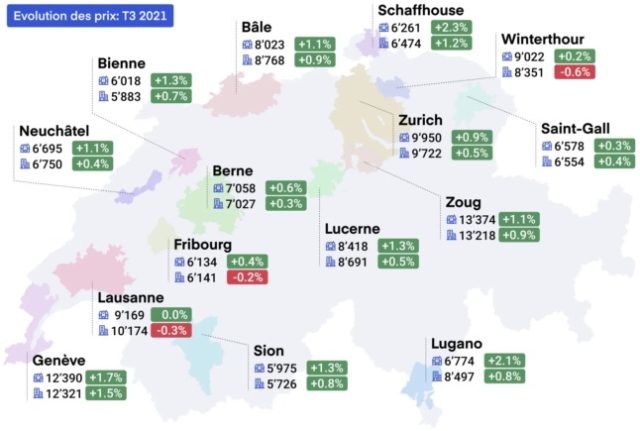

As this RealAdvisor chart indicates, the priciest housing is in urban centres like Geneva, Zurich, and Basel, or locations with a high concentration of multinational companies and residents, such as Zug and Lausanne.

RealAdvisor's chart shows not only by how much property prices have increased between January and September 2021 — 1 percent is a Swiss average — but also the price buyers paid for a square metre of a single-family house or apartment.

Image by RealAdvisor

“This steady rise in prices, although at a more moderate pace this quarter, attests to continued strong demand. But it also signals that there are fewer available properties”, said Jonas Wiesel, RealAdvisor’s co-founder.

The number of apartments for sale dropped most in Biel (-31 percent), Zug (-26 percent) and Lausanne (-23 percent). On the single-home market, the decrease is even more drastic, mainly in Zug (-58 percent), Neuchâtel (-45 percent), Schaffhausen (-38 percent), and Geneva (-28 percent) .

Why do Swiss property prices keep rising?

As The Local explained in a recent article, one major reason for such a low rate of home ownership — and high real estate prices — is scarcity of land.

Switzerland is a small country with little land left to be developed, and the development of whatever land is available is strictly regulated; for instance, agricultural land can’t easily be used for construction.

And as Switzerland’s land is not expandable, “residential real estate will continue to appreciate in value”, Stefan Fahrländer, chairman of the board of Fahrländer Partner, a real estate consultancy firm in Zurich, said in an interview.

READ MORE: How much do you need to earn to afford a house in Switzerland?

The good news, however, is that the situation on the property market is now stabilising in regards to price hikes.

These links provide useful information for all those who are looking for houses or apartments to buy in Switzerland:

READ ALSO: Property in Switzerland: Where are house prices rising the fastest?

Comments

See Also

During the first nine months of this year, house prices rose by 6.2 percent, while apartments went up by 5.2 percent, according to RealAdvisor appraisal platform

Where are the properties most expensive?

As this RealAdvisor chart indicates, the priciest housing is in urban centres like Geneva, Zurich, and Basel, or locations with a high concentration of multinational companies and residents, such as Zug and Lausanne.

RealAdvisor's chart shows not only by how much property prices have increased between January and September 2021 — 1 percent is a Swiss average — but also the price buyers paid for a square metre of a single-family house or apartment.

Image by RealAdvisor

“This steady rise in prices, although at a more moderate pace this quarter, attests to continued strong demand. But it also signals that there are fewer available properties”, said Jonas Wiesel, RealAdvisor’s co-founder.

The number of apartments for sale dropped most in Biel (-31 percent), Zug (-26 percent) and Lausanne (-23 percent). On the single-home market, the decrease is even more drastic, mainly in Zug (-58 percent), Neuchâtel (-45 percent), Schaffhausen (-38 percent), and Geneva (-28 percent) .

Why do Swiss property prices keep rising?

As The Local explained in a recent article, one major reason for such a low rate of home ownership — and high real estate prices — is scarcity of land.

Switzerland is a small country with little land left to be developed, and the development of whatever land is available is strictly regulated; for instance, agricultural land can’t easily be used for construction.

And as Switzerland’s land is not expandable, “residential real estate will continue to appreciate in value”, Stefan Fahrländer, chairman of the board of Fahrländer Partner, a real estate consultancy firm in Zurich, said in an interview.

READ MORE: How much do you need to earn to afford a house in Switzerland?

The good news, however, is that the situation on the property market is now stabilising in regards to price hikes.

These links provide useful information for all those who are looking for houses or apartments to buy in Switzerland:

READ ALSO: Property in Switzerland: Where are house prices rising the fastest?

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.