How do the Swiss manage to save more money than other Europeans?

Despite higher, inflation-driven prices for many consumer goods, households in Switzerland are putting aside more money at the end of each month than their European counterparts, a new study shows.

Even though a recent survey found that about a fifth of Switzerland’s population can’t make ends meet and need more than one job to pay their bills, another one indicates that on average, the Swiss still manage to save more money than other Europeans.

This is what emerges from the new study from HelloSafe consumer platform. It is based its findings on 2021 -2022 figures (the latest available to date), culled from the database of Organisation for Economic Cooperation and Development (OECD).

Savings rates in the study are expressed as a percentage of GDP (gross domestic product), comprising all the savings held by households in relation to the GDP of each country.

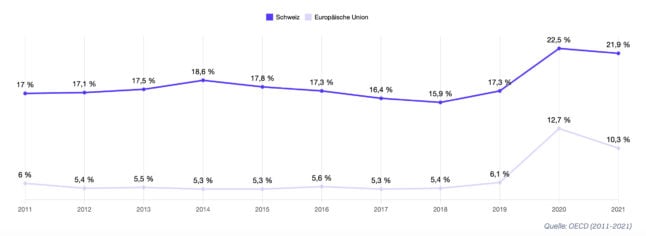

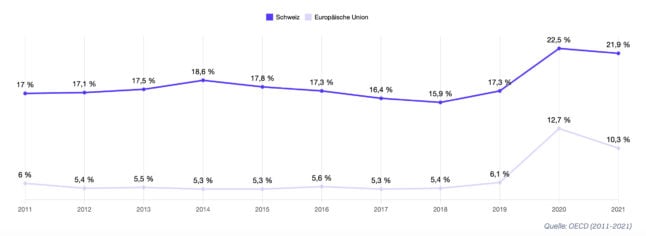

The findings are clear: Swiss households are saving nearly 22 percent of their income, while the European Union recorded an average savings rate of 10.3 percent — that is, 11.6 points below the average Swiss rate.

For instance, looking at just Switzerland’s four immediate neighbours, the rate is 12.8 percent in France, 12 percent in Austria, 11.4 percent in Germany, and 2.1 percent in Italy.

Long-term pattern

The fact that the Swiss are European savings champions is not a new phenomenon.

OECD figures for the past decade show that Switzerland’s population has far outperformed the EU in this area.

Interestingly, as the chart indicates, most savings, both in Switzerland and elsewhere in Europe, were accumulated in 2020, for an obvious reason that at least during some parts of the Covid pandemic, money spending opportunities were largely limited.

Why do the Swiss manage to put away more money than other Europeans?

You might think it is because the wages here are higher than elsewhere, and you are right — income does play a role, even though the cost of living is also correspondingly higher in Switzerland.

However some studies have shown that, taking into account the country’s inflation rate (which is lower than many other European countries), high employment, and strong economy, the purchasing power parity (PPP) — the financial ability of a person or a household to buy products and services with their wages — is higher in Switzerland than in the EU.

READ ALSO: Do wages in Switzerland make up for the high cost of living?

Another OECD study has demonstrated that Switzerland’s average household disposable income per capita is higher than the OECD average. This means that while the Swiss have more money to spend, they also have more to save, if they so choose.

This brings us to yet another reason which explains the savings phenomenon as well.

It has more to do with Swiss mentality and attitude to financial stability, which Alexandre Desoutter, HelloSafe’s editor-in-chief, calls “a prudent and responsible behaviour” towards money.

“Switzerland stands out with a high household savings rate, reflecting its solid financial culture and its commitment to economic stability,” he said.

Comments

See Also

Even though a recent survey found that about a fifth of Switzerland’s population can’t make ends meet and need more than one job to pay their bills, another one indicates that on average, the Swiss still manage to save more money than other Europeans.

This is what emerges from the new study from HelloSafe consumer platform. It is based its findings on 2021 -2022 figures (the latest available to date), culled from the database of Organisation for Economic Cooperation and Development (OECD).

Savings rates in the study are expressed as a percentage of GDP (gross domestic product), comprising all the savings held by households in relation to the GDP of each country.

The findings are clear: Swiss households are saving nearly 22 percent of their income, while the European Union recorded an average savings rate of 10.3 percent — that is, 11.6 points below the average Swiss rate.

For instance, looking at just Switzerland’s four immediate neighbours, the rate is 12.8 percent in France, 12 percent in Austria, 11.4 percent in Germany, and 2.1 percent in Italy.

Long-term pattern

The fact that the Swiss are European savings champions is not a new phenomenon.

OECD figures for the past decade show that Switzerland’s population has far outperformed the EU in this area.

Interestingly, as the chart indicates, most savings, both in Switzerland and elsewhere in Europe, were accumulated in 2020, for an obvious reason that at least during some parts of the Covid pandemic, money spending opportunities were largely limited.

Why do the Swiss manage to put away more money than other Europeans?

You might think it is because the wages here are higher than elsewhere, and you are right — income does play a role, even though the cost of living is also correspondingly higher in Switzerland.

However some studies have shown that, taking into account the country’s inflation rate (which is lower than many other European countries), high employment, and strong economy, the purchasing power parity (PPP) — the financial ability of a person or a household to buy products and services with their wages — is higher in Switzerland than in the EU.

READ ALSO: Do wages in Switzerland make up for the high cost of living?

Another OECD study has demonstrated that Switzerland’s average household disposable income per capita is higher than the OECD average. This means that while the Swiss have more money to spend, they also have more to save, if they so choose.

This brings us to yet another reason which explains the savings phenomenon as well.

It has more to do with Swiss mentality and attitude to financial stability, which Alexandre Desoutter, HelloSafe’s editor-in-chief, calls “a prudent and responsible behaviour” towards money.

“Switzerland stands out with a high household savings rate, reflecting its solid financial culture and its commitment to economic stability,” he said.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.